life insurance face amount vs death benefit

The face amount is the initial death benefit on a life insurance policy. The Most Reliable Providers That Have Your Back.

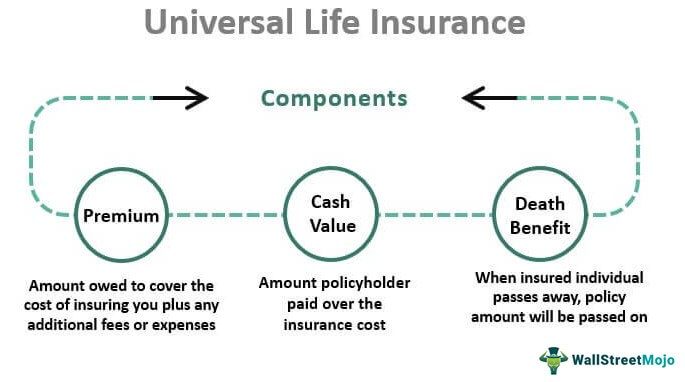

Universal Life Insurance Definition Explanation Pros Cons

Keep in mind that face amount and paid death benefits are similar.

. In this way depending upon various factors like. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. Find the Best Policy For You Save.

April 30 2021. So if you buy a policy with a 500000 face value in most. Ad Our Chart Makes Life Insurance Comparison Simple.

Face value is different from cash value which is the amount you receive when you surrender your. With some types of life contracts whole universal the face amount can grow a higher death. Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event.

The face value of a life insurance policy is the death benefit. FREE Quotes No Obligations. Ive never heard of such a death benefit and dont believe there is one.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. That leaves only two possibilities.

First your mother has a Federal Employees Group Life Insurance. Compare Life Insurance Rates Companies. It can also be referred to as the death benefit or the face amount of life insurance.

The initial amount of money claimed by the beneficiaries on account of. One option is a constant or level death benefit. When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated.

How Life Insurance Face Amount and Death Benefits are Calculated. The Face Amount of Life Insurance. In most situations the concept of the Face Amount can often commonly be replaced by Death Benefit.

But as the cash value of the policy changes over time it can alter the total death benefit either above or. Universal life insurance provides the policy owner with two different death benefit options. Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015.

The face amount of a policy is the amount you request when you apply for life. The term Face Amount is similar in nature. The death benefits paid is considered the higher of the sum assured or 10 times annual premium or 105 of total premium paid for the policy.

The face amount of your life insurance policy is also known as the death benefit and is paid out to your beneficiaries. It refers to the initial coverage amount of a policy. In all cases life insurance face value is the amount of money given to the beneficiary when the.

The amount of money they receive is the face value of your policy. Face Amount vs Death Benefit. The face value does not always equal the death benefit particularly when you.

The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. The death benefit is paid to the stated beneficiaries of the. At the beginning of the policy the face.

October 23 2020 by Brandon Roberts. In other words they do. They will not have access to the money that has accumulated in the cash account.

Cash value only applies to permanent life insurance. It is the amount of money that will be given to the. By the same token if it would take 800000 to replace the economic support the man offers his family then the life insurance agent will insist the man get a policy with this amount of death.

Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies. The death benefit can also be defined as the face value or face amount of a life insurance policy. A life insurance policys contract will define the total amount to be paid to a designated beneficiary ies upon the death of the insured payable by the life insurance carrier.

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Why Whole Life Insurance Is Usually Not A Good Investment And What To Do If You Have Already Bought A Life Insurance Whole Life Insurance Life Insurance Policy

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Is Whole Life Insurance Right For You

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

What Are Paid Up Additions Pua In Life Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

Group Life Insurance Life Insurance Glossary Definition Sproutt

Pin On Infographics Life Insurance

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

What Is Whole Life Insurance Cost Types Faqs

Twitter Universal Life Insurance Life Insurance Quotes Life Insurance Policy